bills of exchange act pdf

The Bills of Exchange Act is available as a pdf download, providing access to the Act’s content, including sections and definitions, on the UK government website online easily always.

Overview of the Act

The Bills of Exchange Act provides a comprehensive framework for bills of exchange, cheques, and promissory notes, codifying the law relating to these financial instruments. The Act is divided into sections, each dealing with a specific aspect of bills of exchange, such as definition, form, and interpretation. It also covers topics like acceptance, endorsement, and payment, providing clarity on the rights and obligations of parties involved. The Act’s provisions are designed to facilitate trade and commerce by establishing a standardized system for the creation, negotiation, and discharge of bills of exchange. By downloading the Act as a pdf, users can access the full text of the legislation, including the arrangement of sections, and gain a deeper understanding of the law governing bills of exchange. This knowledge is essential for businesses, financial institutions, and individuals engaged in commercial activities. The Act’s overview is a crucial starting point for understanding its application and implications.

Key Definitions

The Bills of Exchange Act provides key definitions for terms like bill of exchange, acceptance, holder, indorsement, issue, value, and written. These definitions are crucial for understanding the Act’s provisions and applying them in practice. The Act defines a bill of exchange as an unconditional order in writing, addressed to a specified person, requiring them to pay a certain sum of money. The definition of acceptance is also provided, referring to the drawee’s agreement to pay the bill. Other key terms, such as holder and indorsement, are defined to clarify the rights and obligations of parties involved in the transaction. By understanding these definitions, users can better navigate the Act and apply its provisions to real-world scenarios, ensuring compliance with the law and minimizing potential disputes. The definitions are an essential component of the Act, providing a foundation for its application.

Structure of the Act

The Act is divided into parts and sections, with a clear arrangement of content, making it easily accessible and navigable online always for users to read.

Arrangement of Sections

The Bills of Exchange Act is organized into a logical arrangement of sections, with each section addressing a specific aspect of the Act. The sections are grouped into parts, making it easier to navigate and understand the content. The Act’s arrangement of sections includes preliminary sections, followed by sections on bills of exchange, cheques, and promissory notes. The sections are further divided into subsections, providing detailed information on various topics, such as the definition of a bill of exchange, the requirements for a valid bill, and the rules for acceptance and payment. The clear arrangement of sections enables users to quickly locate specific information and understand the Act’s provisions. The Act’s structure and arrangement of sections are designed to provide a comprehensive and accessible framework for understanding the law relating to bills of exchange and other financial instruments. The online pdf version of the Act retains this arrangement.

Section Highlights

Key sections of the Bills of Exchange Act provide essential information on the law relating to bills of exchange, cheques, and promissory notes. Notable sections include those defining important terms, such as bill of exchange, acceptance, and holder. Other sections outline the requirements for a valid bill, including the need for a clear address of the drawee and certainty as to the amount and payment details. The Act also covers topics like indorsement, issue, and value, providing clarity on these critical concepts. The section highlights demonstrate the Act’s comprehensive approach to regulating financial instruments, ensuring that users understand their rights and obligations. By examining these key sections, users can gain a deeper understanding of the Act’s provisions and how they apply to real-world situations, making the online pdf version of the Act a valuable resource for reference and guidance. The sections work together to provide a complete picture.

Amendments and Revisions

Amendments to the Act were made in 1906, 1914, and 1917, updating the law to reflect changing financial practices and requirements effectively online always.

Amending Acts

The Bills of Exchange Act has undergone several amendments since its inception, with notable changes made in 1906, 1914, and 1917. These amending! acts aimed to update the law to reflect changing financial practices and requirements. The amendments were enacted to clarify and refine the provisions of the Act, ensuring it remained relevant and effective in governing bills of exchange, cheques, and promissory notes. The amending acts were carefully drafted to address specific issues and concerns, and their provisions were incorporated into the main Act. As a result, the Act has evolved over time, providing a comprehensive framework for the use of bills of exchange and other financial instruments. The amending acts have played a crucial role in shaping the current state of the law, and their impact continues to be felt in the financial sector today, with the Act remaining a key piece of legislation.

Revised Editions

The Bills of Exchange Act has been revised and updated several times, with new editions reflecting changes to the law and financial practices. These revised editions provide a consolidated version of the Act, incorporating amendments and updates. The revised editions are published by the UK government and are available for download as a pdf, making it easy to access the most up-to-date version of the Act. The revised editions include explanatory notes and indexes, which help to clarify the provisions of the Act and provide guidance on its application. The revised editions are an essential resource for anyone working with bills of exchange, cheques, and promissory notes, as they provide a comprehensive and authoritative guide to the law. The revised editions are regularly updated to ensure they remain relevant and effective in governing financial transactions. This ensures the Act remains a key piece of legislation.

Availability of the Act

The Act is available as a pdf download online from the UK government website easily and quickly always with updated information and sections included in the document.

PDF Download

The Bills of Exchange Act is available for download as a PDF file from the UK government website, allowing users to access the Act’s content offline. The PDF download feature enables users to save the document on their devices and access it at any time. The PDF file contains the full text of the Act, including all sections and definitions, and is formatted for easy reading and navigation. The download process is straightforward, and users can access the PDF file by visiting the UK government website and following the links to the Bills of Exchange Act page. Once downloaded, the PDF file can be viewed using any PDF reader software, making it a convenient option for users who need to reference the Act regularly. The PDF download option is a useful resource for anyone who needs to access the Bills of Exchange Act.

Online Access

The Bills of Exchange Act can be accessed online through the UK government website, providing users with a convenient and easily accessible way to view the Act’s content. The online version of the Act is regularly updated to reflect any changes or amendments, ensuring that users have access to the most current information. The website is user-friendly and allows users to search for specific sections or keywords within the Act, making it easier to find relevant information. Additionally, the online version of the Act is available at all times, allowing users to access it from anywhere with an internet connection. The online access option is particularly useful for users who need to reference the Act frequently or for those who prefer to access information digitally. The UK government website provides a reliable and trustworthy source for accessing the Bills of Exchange Act online.

The Bills of Exchange Act provides a framework for exchange transactions, available as a pdf download, summarizing key points and definitions easily online always.

Importance of the Act

The Bills of Exchange Act is crucial in governing exchange transactions, providing a framework for businesses to operate within. The Act’s importance lies in its ability to clarify and codify the law relating to bills of exchange, cheques, and promissory notes. By doing so, it establishes a clear understanding of the rights and obligations of parties involved in these transactions. This, in turn, helps to reduce disputes and promote confidence in the use of these financial instruments. The Act’s importance is further emphasized by its widespread adoption and recognition, making it a fundamental component of modern business practices. As a result, the Act remains a vital piece of legislation, continuing to play a significant role in shaping the financial landscape. Its provisions and guidelines are essential for businesses, individuals, and financial institutions to navigate the complexities of exchange transactions.

Relevance to Modern Business

The Bills of Exchange Act remains relevant to modern business, as it continues to govern various financial transactions. The Act’s provisions on bills of exchange, cheques, and promissory notes are still widely used today, making it essential for businesses to understand and comply with its requirements. In today’s globalized economy, the Act’s guidelines on international transactions are particularly important, helping to facilitate trade and commerce across borders. Furthermore, the Act’s emphasis on clarity and certainty in financial dealings has become even more critical in the digital age, where transactions are often conducted electronically. As a result, the Act remains a vital tool for businesses, financial institutions, and individuals, providing a framework for secure and efficient financial transactions. Its relevance is evident in its continued use and reference in modern business practices, ensuring the smooth operation of financial markets.

Related Posts

365 days with self discipline pdf

Discover the ultimate guide to building self-discipline in just 365 days. Download the PDF now and start transforming your life!

costanzo physiology pdf free download

Get instant access to Costanzo Physiology PDF. Download the full textbook for free and start learning today!

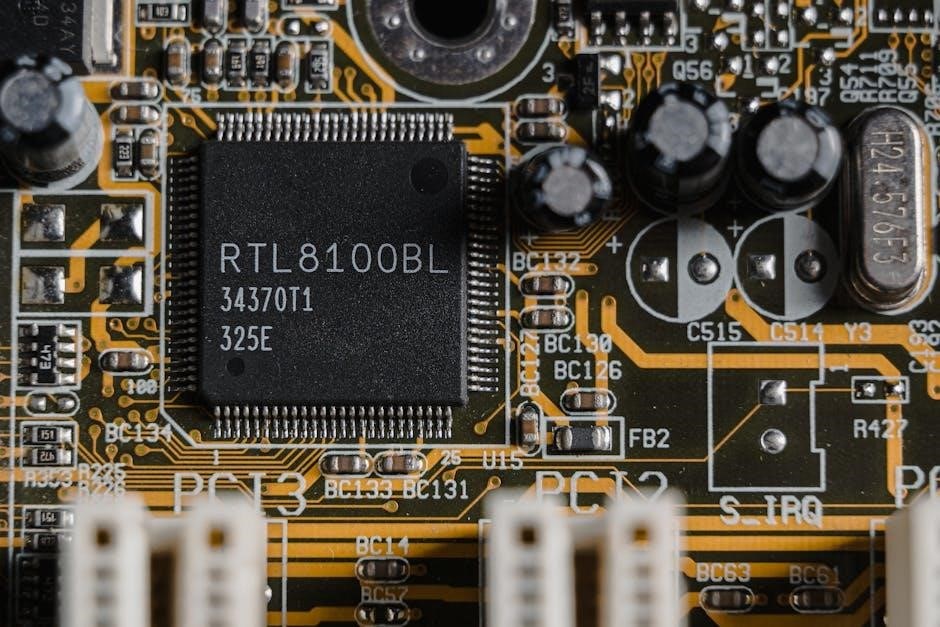

computer motherboard parts and functions pdf

Explore the ultimate guide to computer motherboard components and their functions in this detailed PDF resource.